- Weekly unemployment rate:

The number of initial applications for unemployment benefits in the United States dropped from 787 to 712, and the number of additional applications for unemployment benefits in the United States fell from 6,089 to 5,520. Through these two data, we can clearly know that the employment environment in the United States is continuously improving, the unemployment rate is continuously falling, and more and more people are returning to work. This situation is good news for the economic recovery of the United States. . Regarding this indicator, I don’t think there will be much change in the short term. The only thing to note is that it is still at a historical high and the unemployment rate still needs to continue to fall, and eventually return to the normal range.

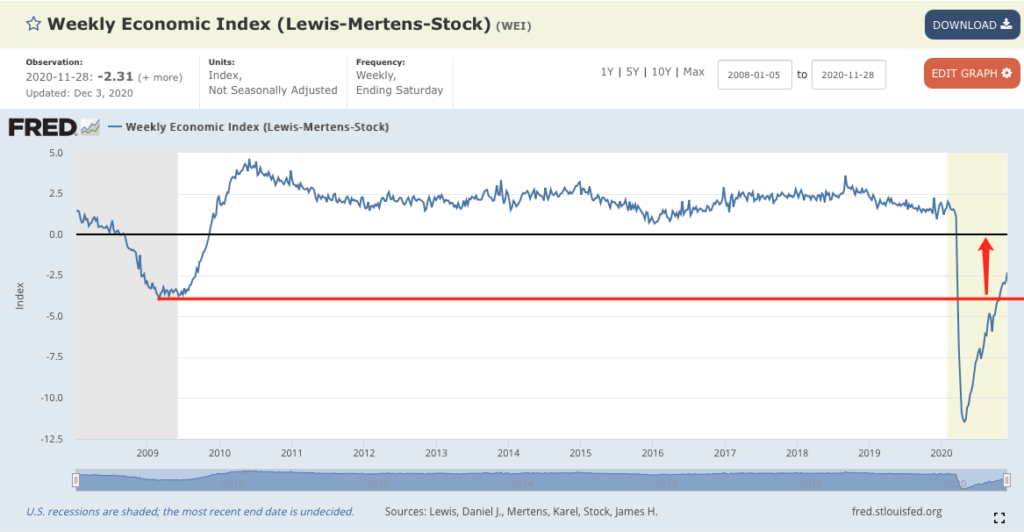

- New York Fed’s Economic Activity Index (WEI)

The US economy is recovering well, and the WEI index continues to rise.

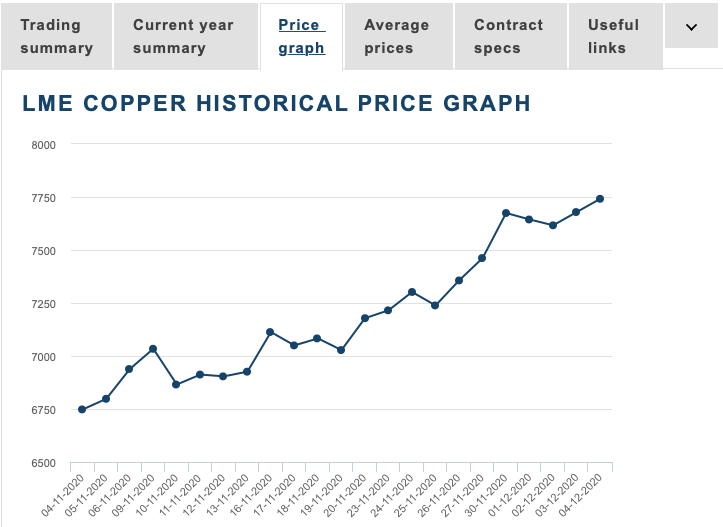

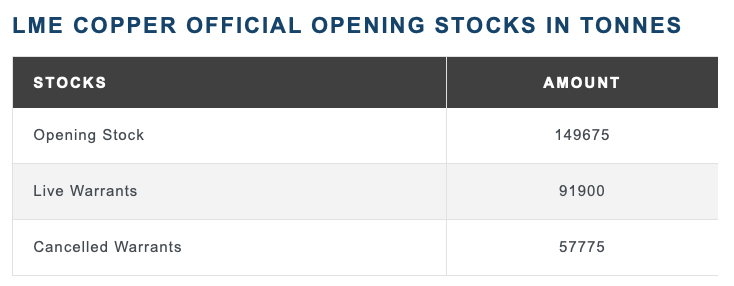

- Copper inventory of the three major exchanges (London Futures Exchange, Shanghai Futures Exchange, New York Mercantile Exchange):

The copper stocks of the three major exchanges rose slightly, but the downward trend in copper stocks since four weeks has supported the sharp rise in copper prices. Copper is an important industrial metal, and the price of copper reflects the degree of economic activity, which shows that the economic activity of the United States continues to rise.

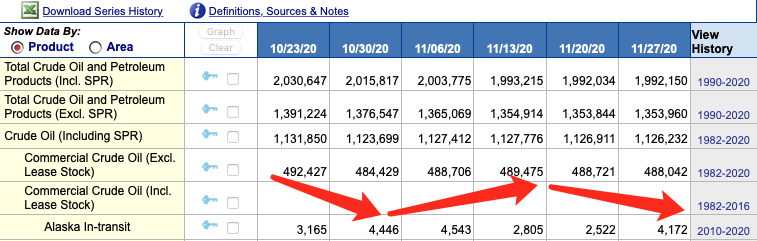

- US crude oil inventory and production data:

There were no major changes in crude oil inventories and production this week, but crude oil prices have risen sharply in the past two weeks. Please see the figure below for data changes:

- Redbook (retail same store sales index):

This week’s Redbook Index has undergone tremendous changes, rising sharply and hitting a record high. I once mentioned that the willingness, ability, and way of consumption of American residents have undergone tremendous changes. Due to the epidemic, people will gradually adapt to the online shopping model; the online shopping trend that is ten years later than China has gradually arrived. Online shopping will be an important new investment focus in the future.

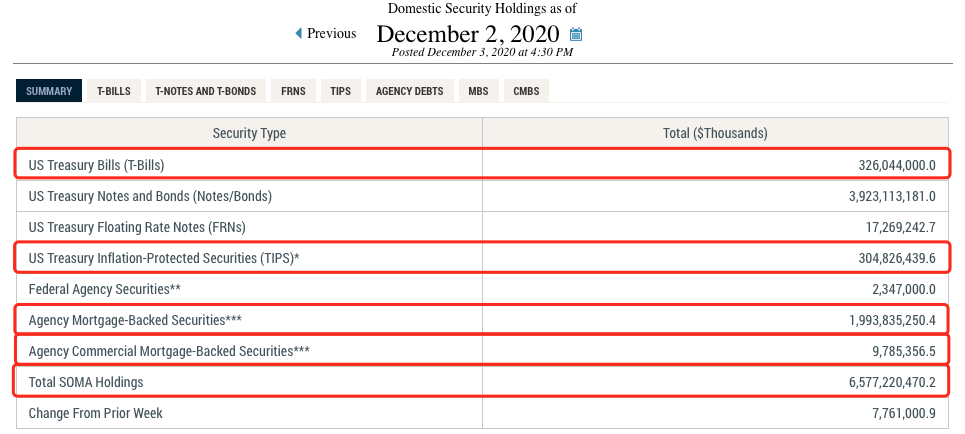

- he Fed’s position in the open market (Fed System Open Market Holdings):

The Fed’s public position data is still near the high level, and it is still buying bonds.

Summary:

Copper price, employment, and WEI, these three indexes contribute to the recovery of the U.S. economy, but we also know that this is because the Federal Reserve and the U.S. government support the market. Therefore, we still don’t need to worry too much, especially the information about vaccines is gradually increasing. It is clear that the speed of economic recovery will remain unchanged, and in the short to medium term, we still treat the stock market with a bullish attitude.