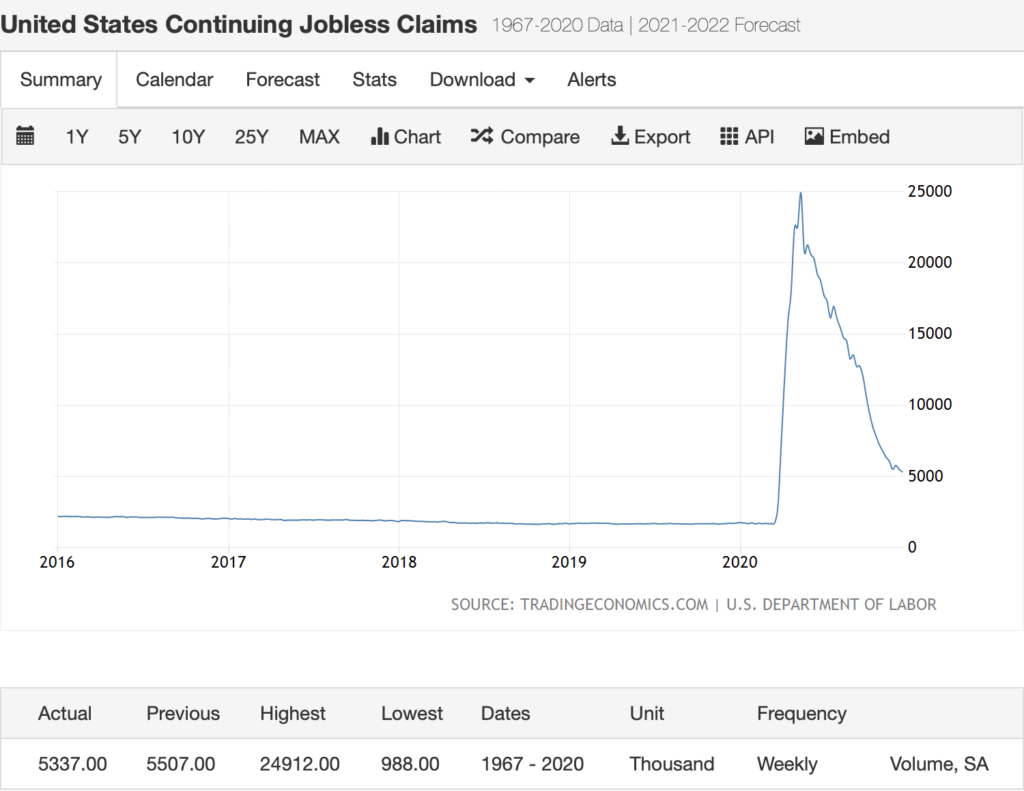

- Weekly unemployment rate:

In the past two weeks, due to the recurrence of the epidemic, many areas have implemented the stay-at-home order again, which has caused a small amount of panic in the market. However, according to the employment rate data, the vast majority of the people did not lose their jobs, nor did the unemployment rate rise again. Combining the following Covid-19 infection rate and death toll, we can find that the risk of the epidemic to people’s survival seems to be gradually decreasing, because the death rate is gradually decreasing (of course, it may just be because the number of infections has increased and the death toll remains unchanged). But in terms of statistics, the number of unemployed people during this period has gradually decreased, and society has also tended to develop steadily. This is good news.

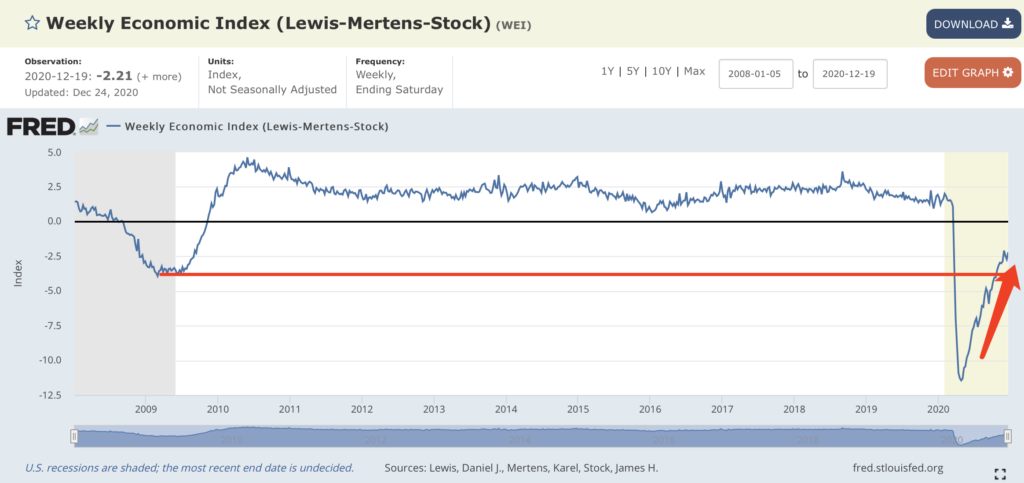

- New York Fed’s Economic Activity Indicator (WEI)

As the peak of the epidemic declined, the WEI index in the past two weeks has continued to rise, exceeding the 2008 low. The economic recovery is still in progress, although the value of WEI is still in the negative range. Looking forward to the popularity of subsequent vaccines, this value can continue to rise.

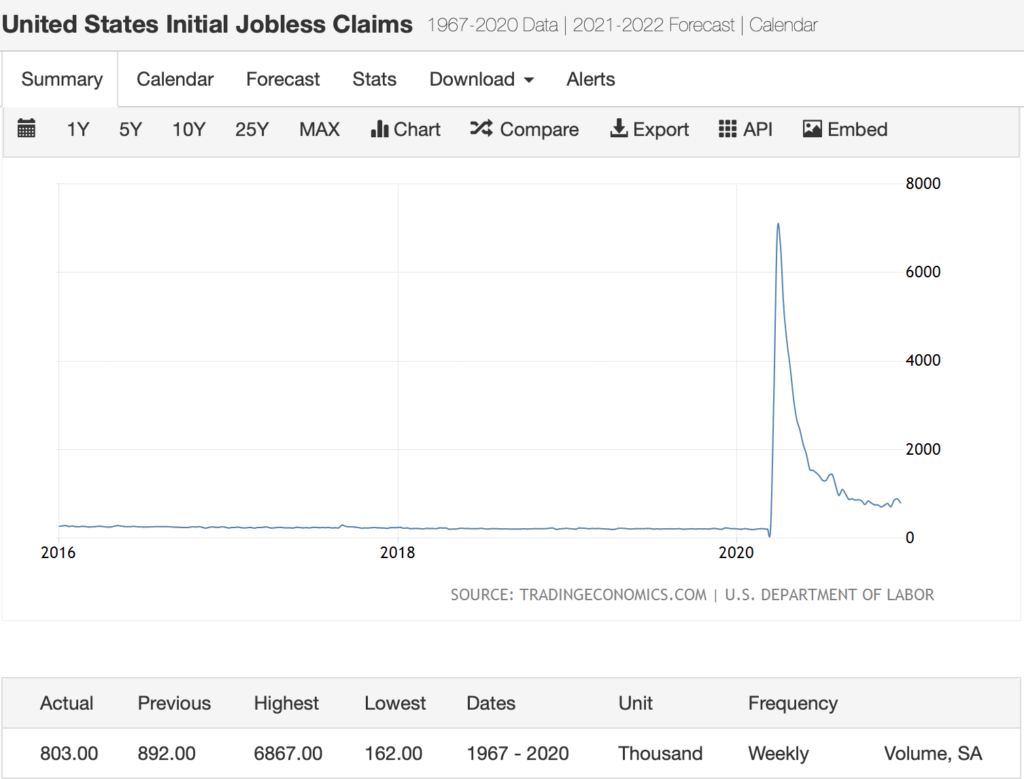

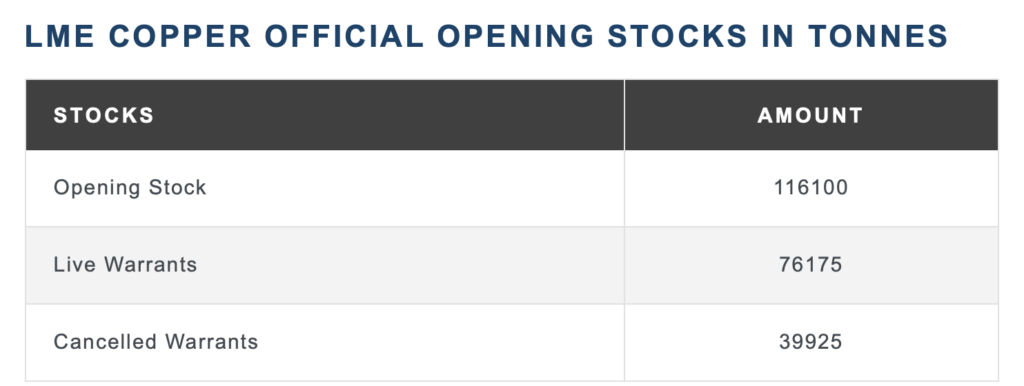

- Copper Stock

The copper stocks of the three major exchanges continued to decline, supporting the continued strength of copper prices. Copper prices have risen by 70% from their lows in March, setting a new high since 2013. If copper stocks remain low for 1-2 years (like 2004-2006), then copper prices may continue to hit new highs.

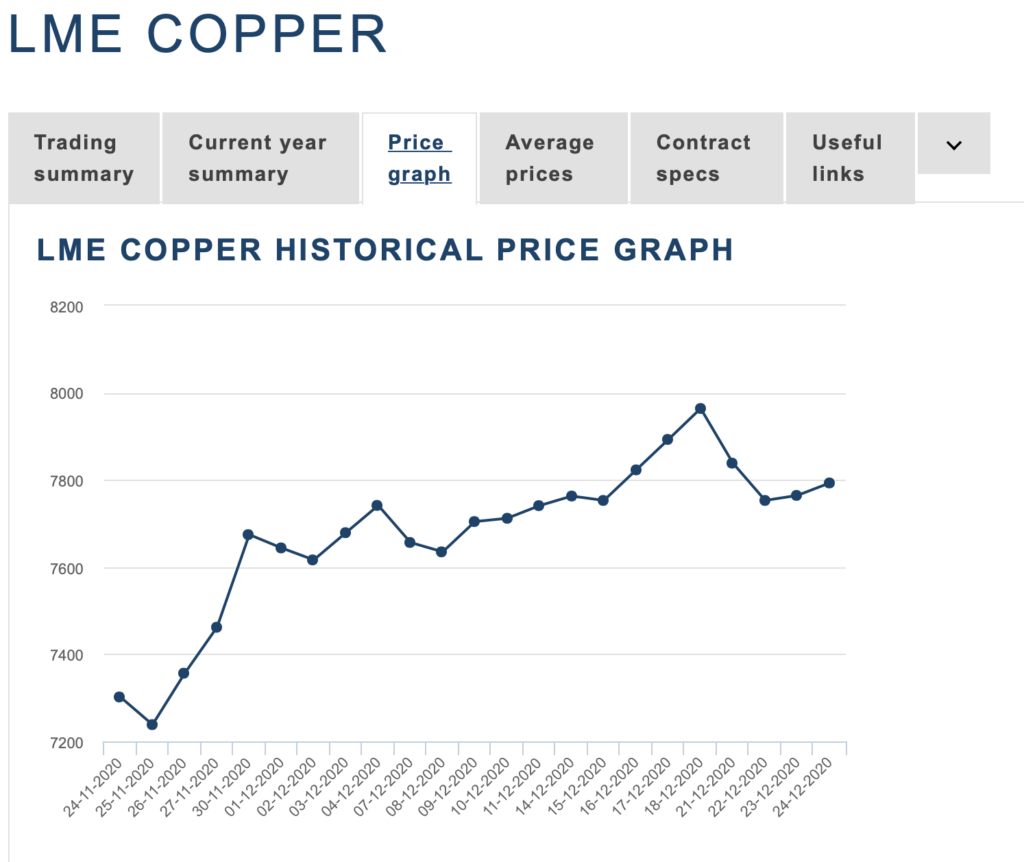

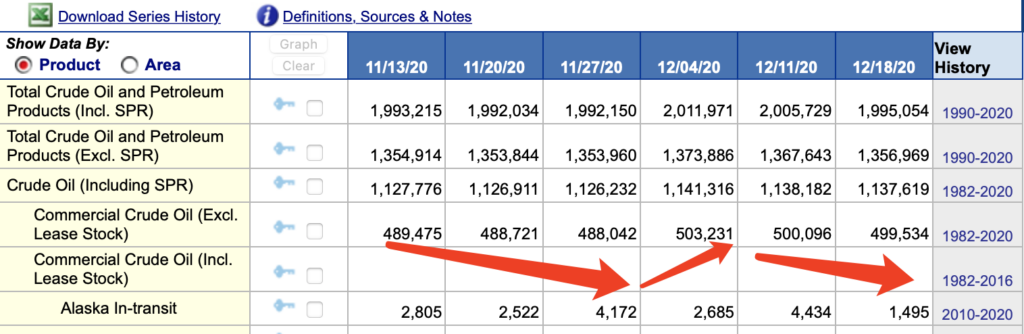

- US crude oil inventory and production data

The latest data shows that the US crude oil production and inventories have not changed much, but oil prices seem to show no signs of stopping. Let us continue to look forward to it. Rising oil prices will lead to a rise in CPI.

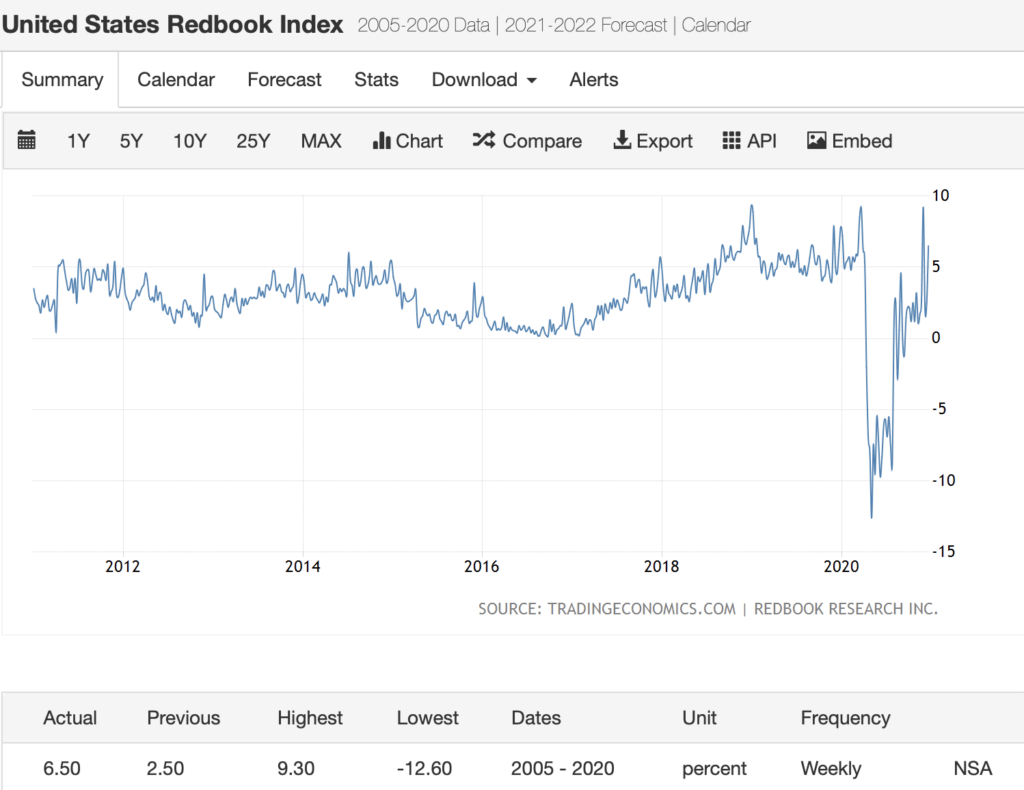

- Redbook (retail same store sales index)

Physical retail stores continue to grow stronger, and the situation in large shopping malls is still not optimistic.

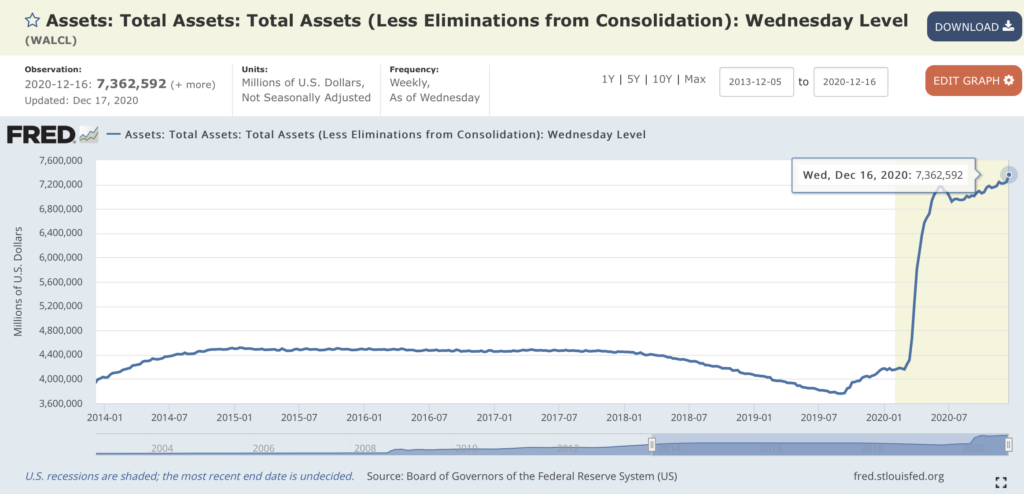

- The Fed’s position in the open market

The Fed is still buying. We need to master a basic theory. The prices in the capital market are mainly determined by buyers. When the Fed is still buying in large quantities, we can assume that the financial market is still working hard. Therefore, as long as the Fed does not stop buying, we can rest assured.

- Key points:

a. The sharp rise in copper and oil prices will cause the PPI and CPI to rise. When these two indexes rise in resonance, the purchasing power of people’s cash will decrease, commonly known as depreciation.