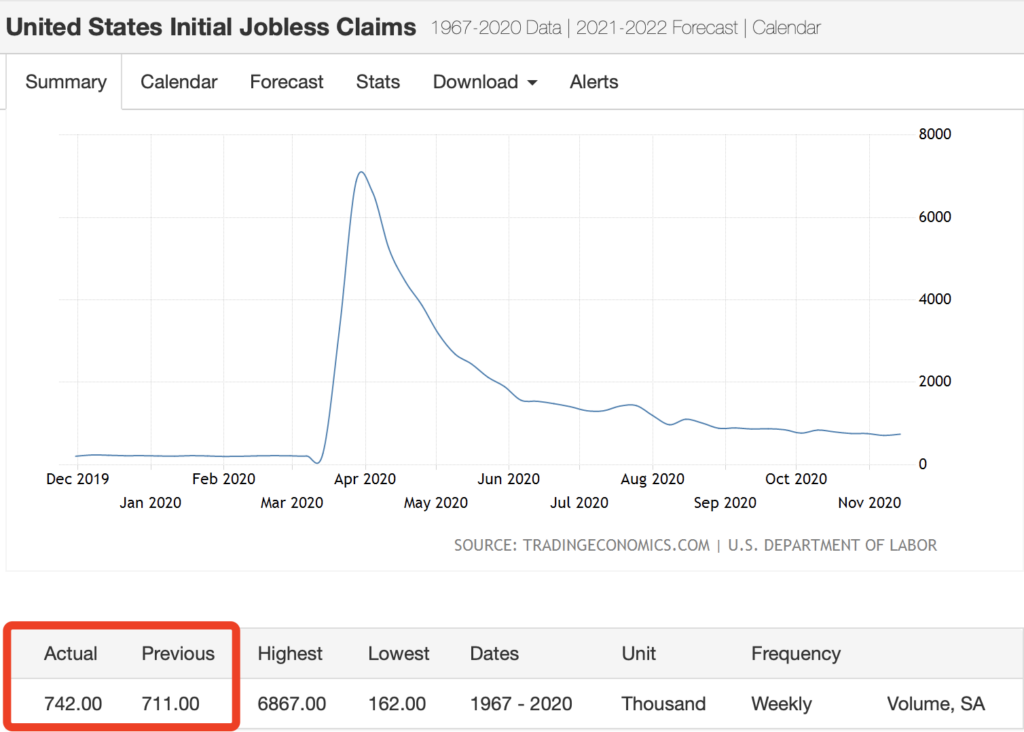

- Weekly unemployment rate:

The data of Initial Jobless Claims rebounded slightly this week, from 711 recorded last time to 742 today, which is a incremental data; the data of Countinuting Jobless Claims keeps going down this week, from 6801 to 7372 which is a stock data. Although the IJC is going up this week, it is still in downward trend, so in the expectation of market, the unemployment rate connot rise significantly. But one thing we need to care about is that, the number is still at a high level, and such an number cannot back to the normal level before vaccine is universal.

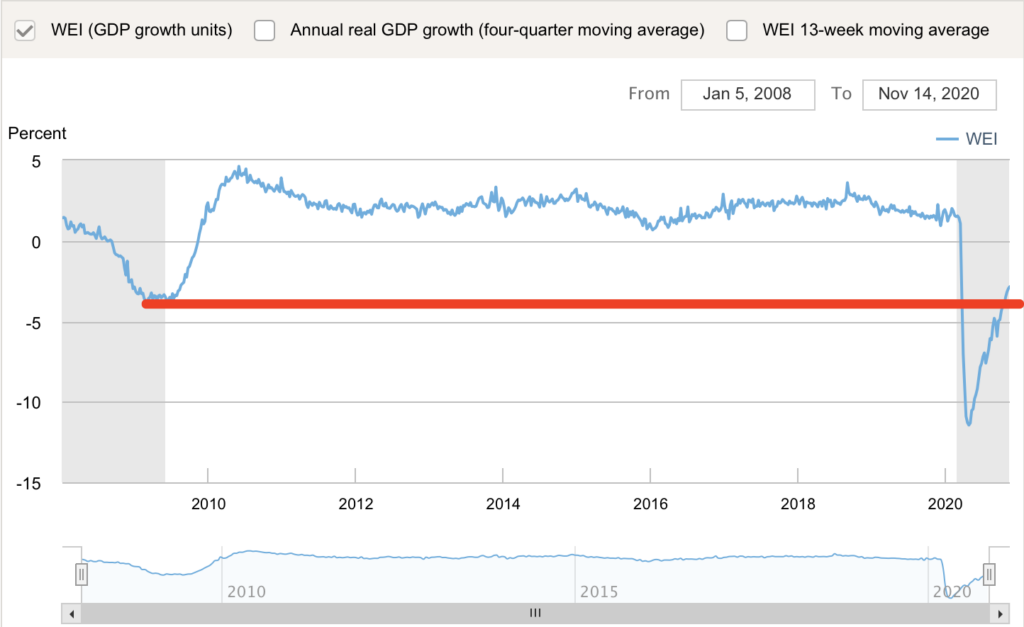

- The New York Fed’s Economic Activity Index (WEI):

The WEI indicator has performed quite well. It has risen rapidly in the past two weeks and broke through the low point of 2008, and continues to develop towards the 0 axis. This is undoubtedly a good phenomenon. Here we need to know that the positive range represents economic expansion, and the negative range represents economic contraction. Although this indicator is in a negative range, the trend is positive, so we can continue to have a positive attitude towards economic recovery.

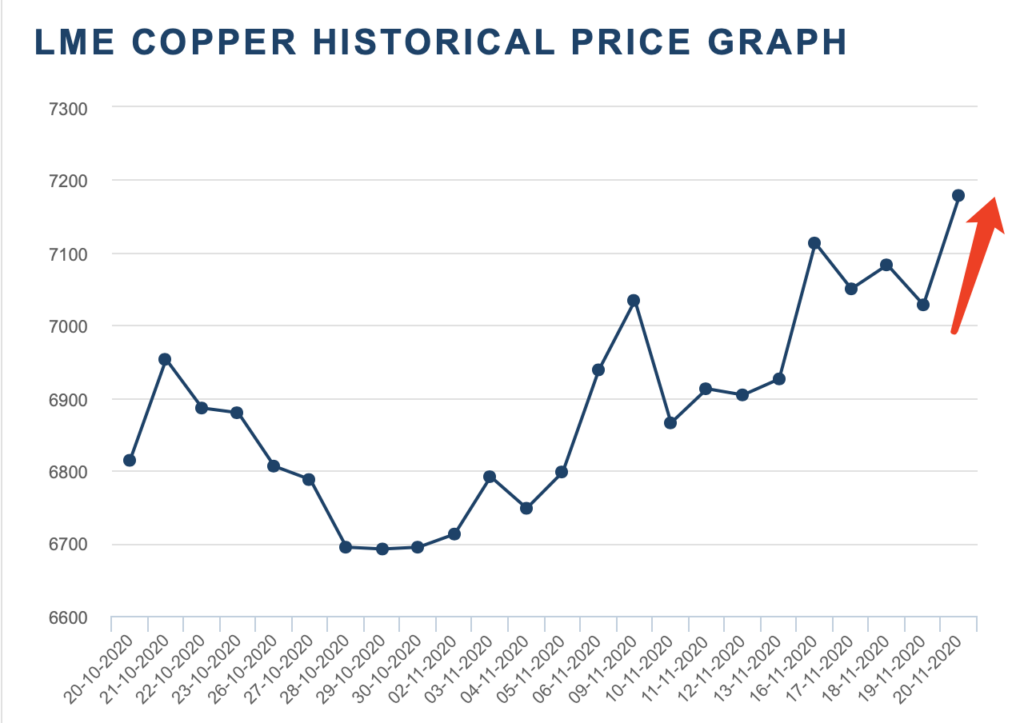

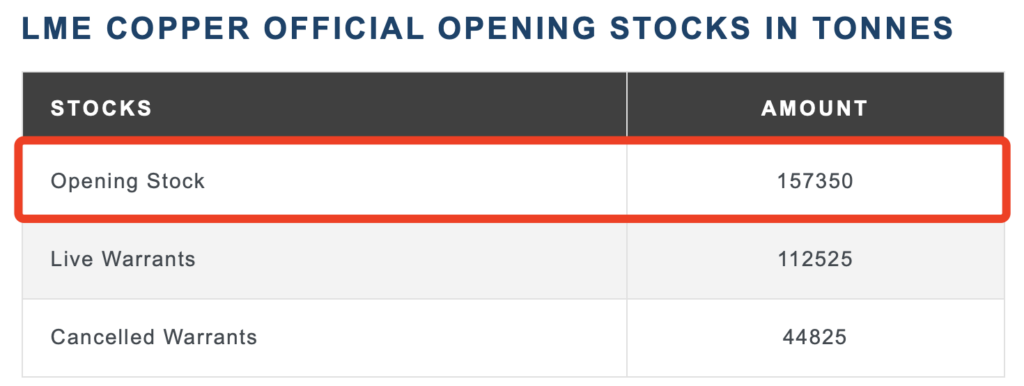

- Copper inventory of the three major exchanges (London Futures Exchange, Shanghai Futures Exchange, New York Mercantile Exchange)

The copper stocks of the three exchanges continued to fall. This is a continuous decline since the rise of copper stocks a month ago, leading to the continuous rise of copper prices, which is just one step away from the previous high.

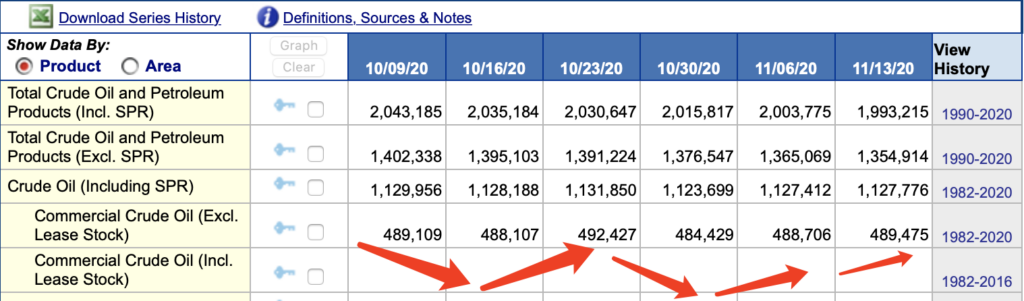

- US crude oil inventory and production data:

According to the data, crude oil inventories and production have not changed much in the past week, and they fluctuate slightly within a range. Although morphologically speaking, they will be more suitable for bullish trends, more observation is needed.

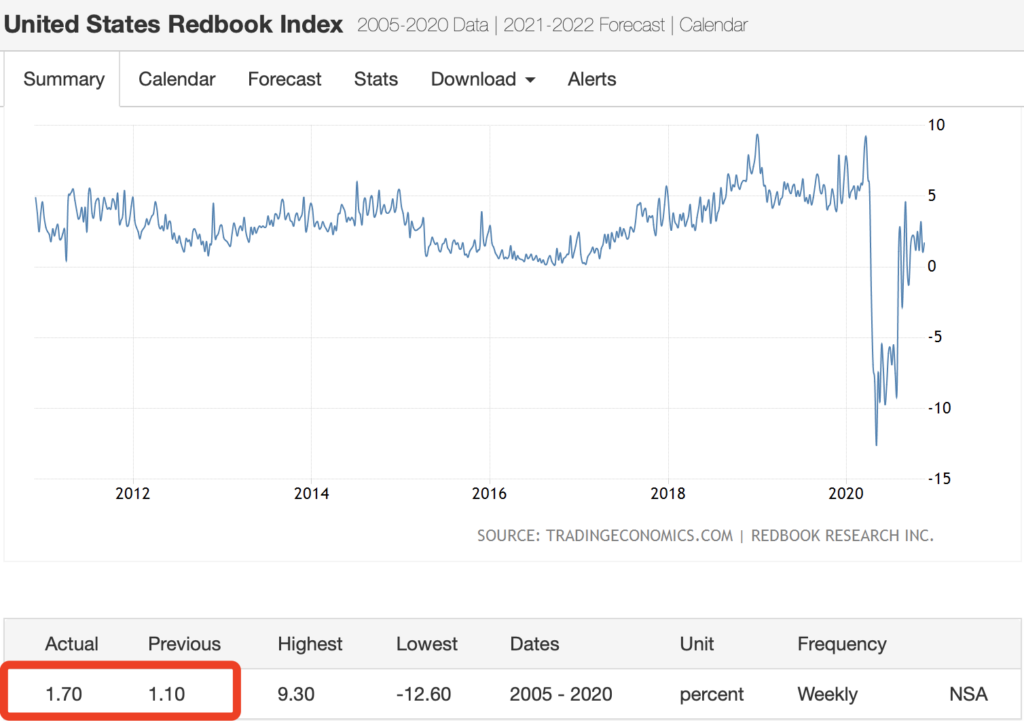

- Redbook (retail store sales index):

Under the current situation, this data is obviously impossible to display well. The epidemic has led to tremendous changes in the consumption intentions and consumption patterns of American people. The era of online shopping has come. This has dealt a severe blow to business models that require human traffic and has a structural negative impact.

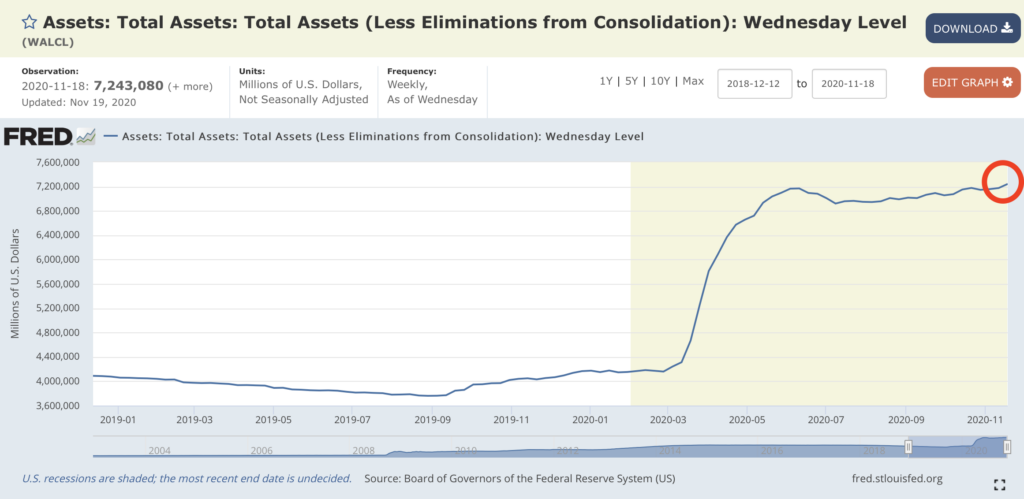

- The Fed’s position in the open market (Fed System Open Market Holdings):

This data is still at a new high, including: TIPS, AMBS, T-Note. In other words, the Fed is still buying in large quantities. We need to know that the level of asset prices is mainly determined by buyers. Then we clearly recognize that the Fed is the largest buyer in the world. As long as the Fed has not stopped buying, then this bond stock market game will continue. Therefore, the stock market There is no suitable reason for a sharp drop.

Summary:

a. Unemployment rate, WEI index, and copper inventory mutually confirm an important fact: the recovery of the real economy is proceeding in an orderly manner.

b. With the support of the Federal Reserve and the US government, the US economic recovery is good. Certain industries and companies are transforming, and the real economy is gradually adapting to this new normal. Personally, I subjectively believe that the Fed and the US government will not stop supporting at this time, especially during the handover of the US president. I think we should wait until a favorable turning point has occurred and most commercial organizations have adjusted to the new normal before considering the next action.

c. Due to this epidemic, the United States has printed a large number of banknotes. How will it be done? I will publish an article on this topic for analysis.