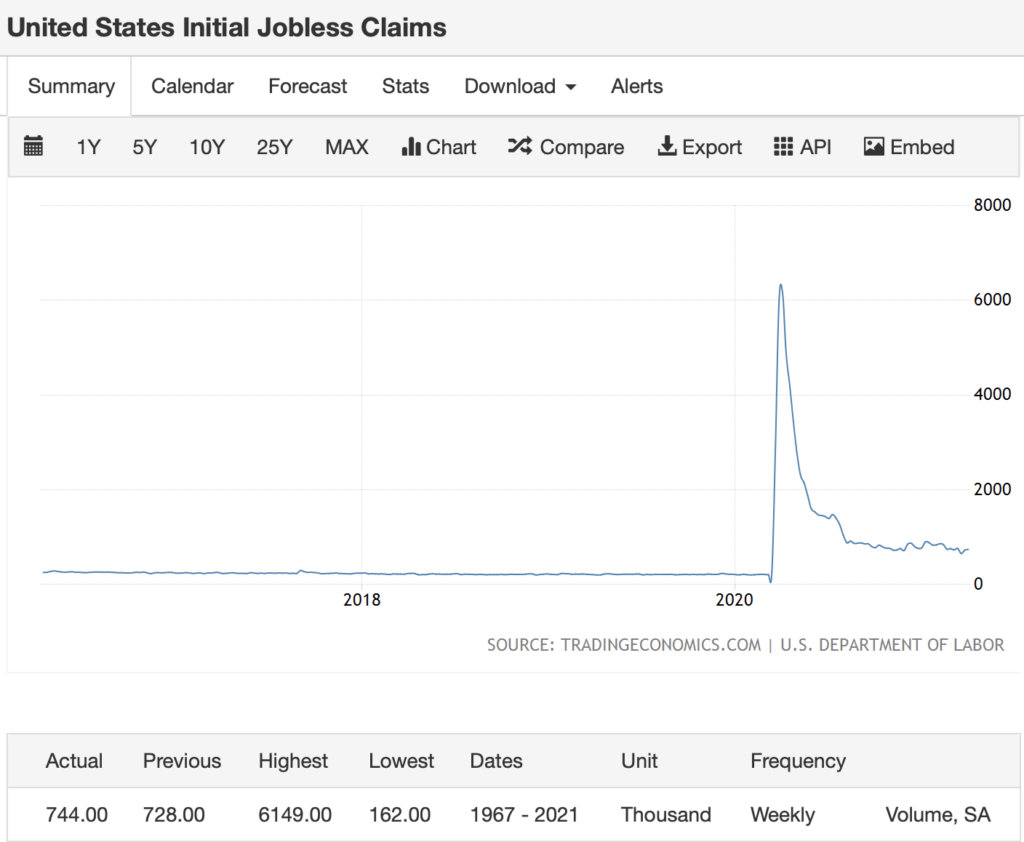

- Weekly Unemployment Rate:

The number of Initial Jobless Claims and Continuous Jobless Claims has fluctuated in a small range for a period of time. As we discussed last time, although the number of initial claims has not continued to decline, the continued claims are still In an obvious downward trend. Obviously, this shows that the restricted economic activities caused by Covid-19 will gradually be alleviated. But there is still a serious problem that needs our attention. Compared with the past 5-10 years, the number of initial jobless claims is still at a high level. Will the high unemployment rate become a new normal? Of course, the main reason is the help of stimulus check. Many people would get unemployment benefits at home rather than go out to work, this is not a good phenomenon for the economic development of the society. We still need to pay more attention to the government’s rescue plan if there is any further corrections.

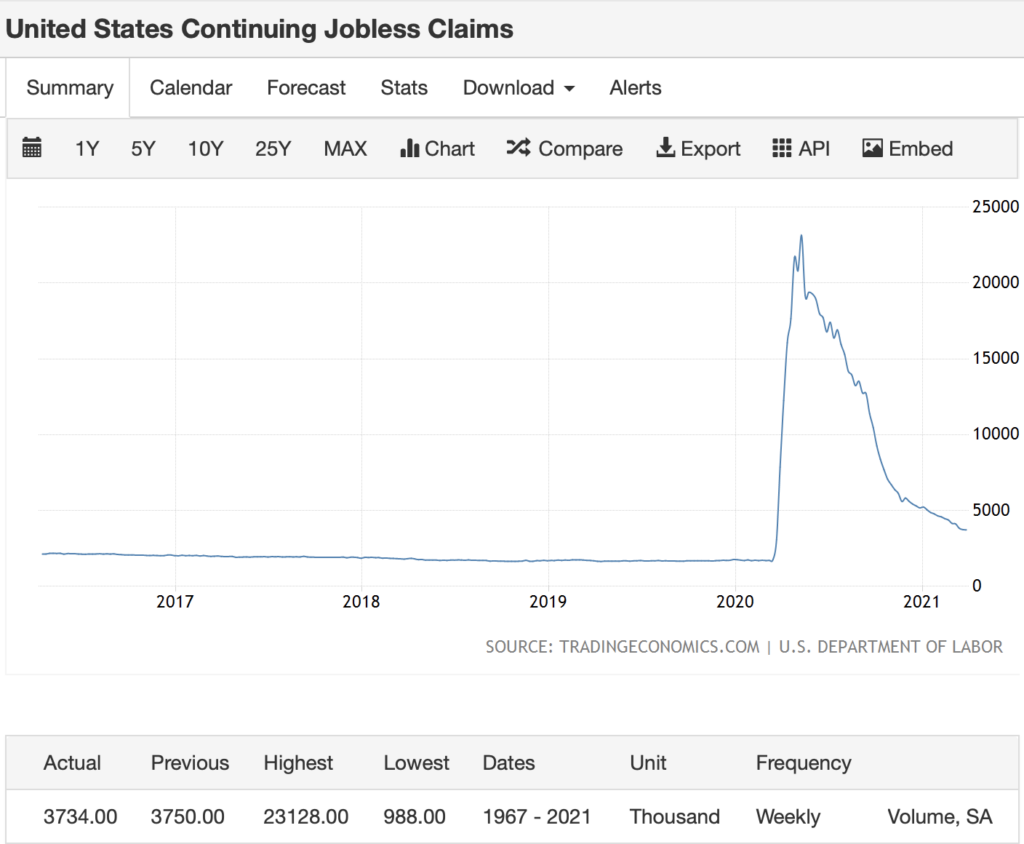

- The New York Fed’s Economic Activity Index (WEI):

The WEI index has seen a sharp rise in the past period of time. When the WEI index is positive, it represents economic expansion; otherwise, it represents economic contraction. From the chart below, we can see that this is the first time since the epidemic last year that it has broken through the positive range, and there has been an astonishing increase. This represents a substantial increase in economic activity in the past period of time. This is a very good phenomenon. At the same time, we can have better expectations of other economic activities in society.

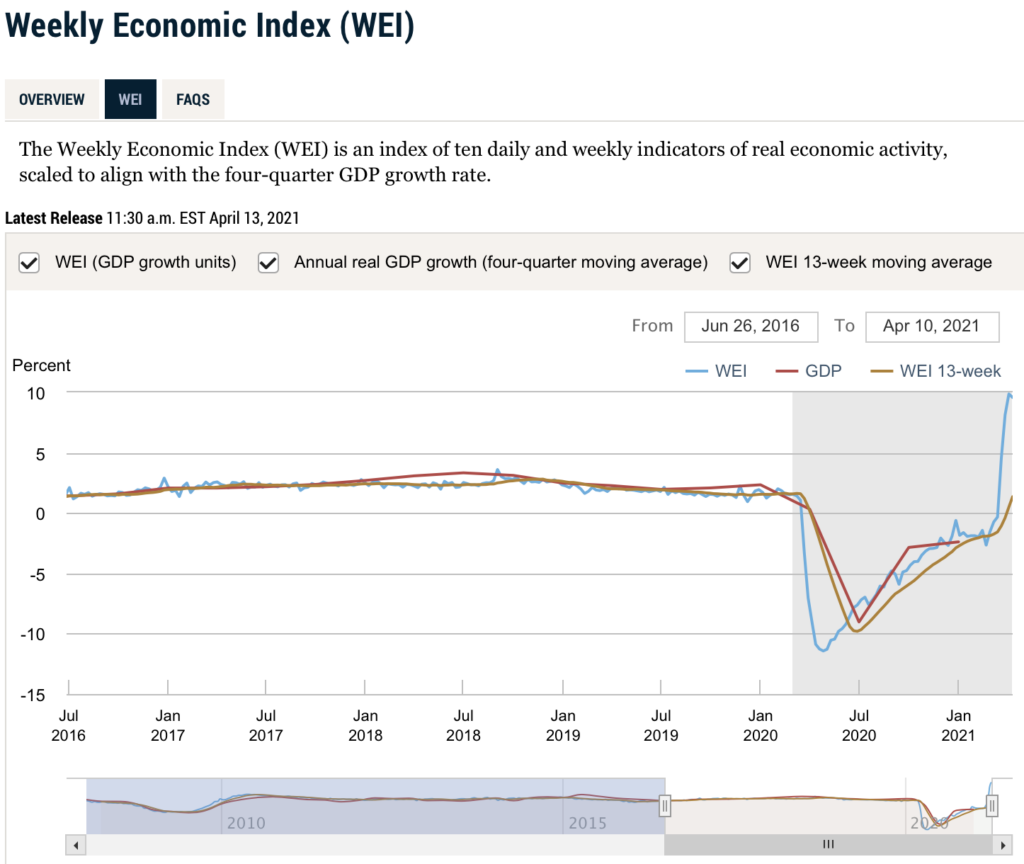

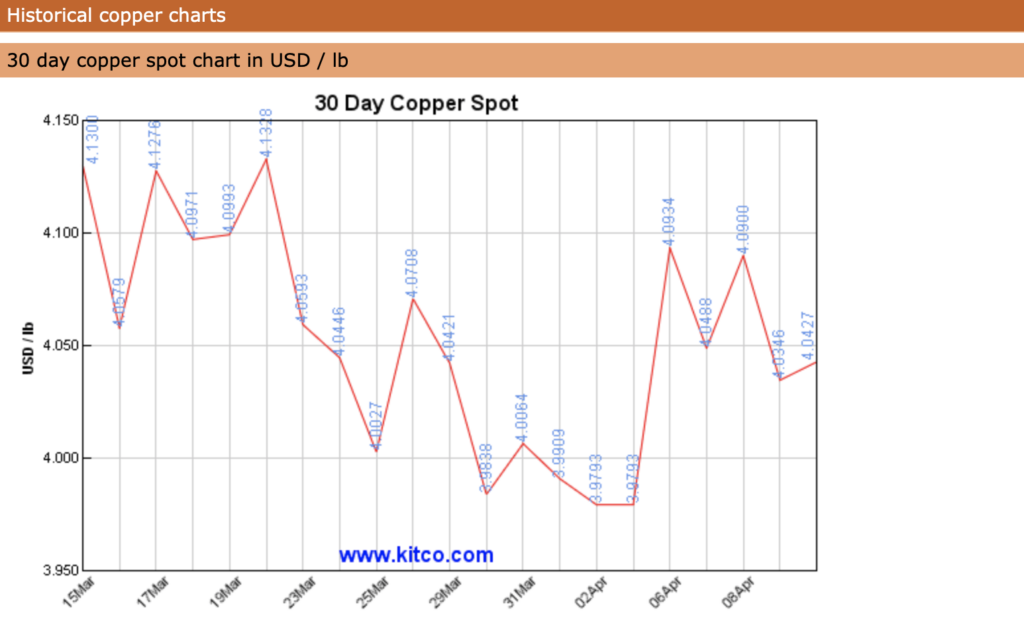

- Copper inventory of LME

The copper inventory data has continued to rise in the past period of time. Through the supply and demand relationship of bulk commodities, the upward trend of copper prices has been under relatively greater pressure here. Last year, due to the epidemic, the suspension of most economic activities indirectly caused the current unexpected demand for copper; now as copper stocks gradually recover, copper prices will also enter an adjustment range until all market costs are sorted out. Enter the next stage of the market.

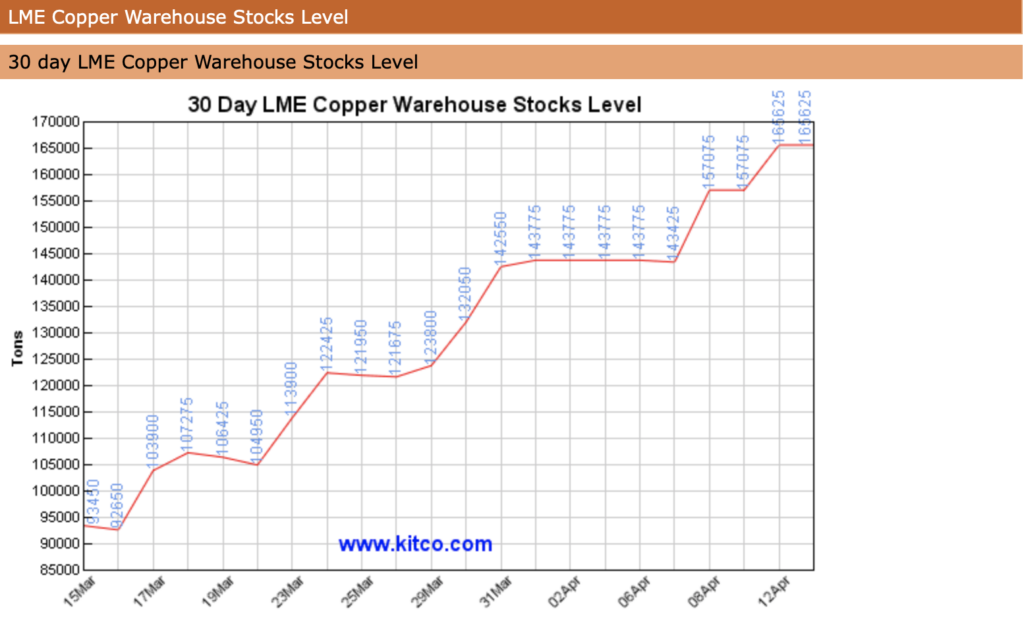

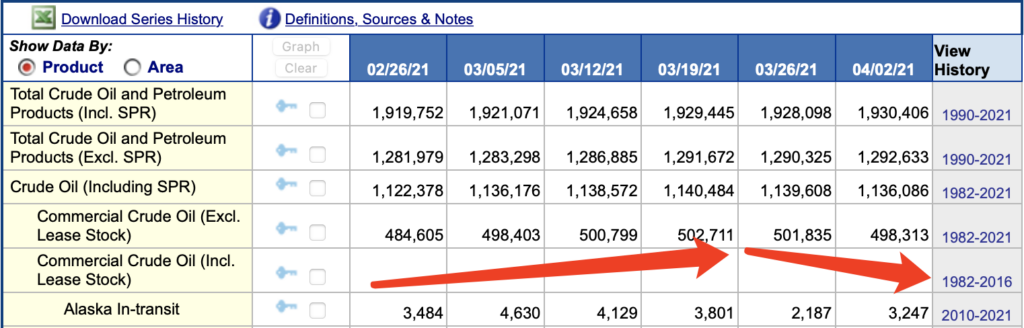

- Data on crude oil inventories and production in the United States:

Crude oil inventory data is similar to copper inventory data above, and it has also reached a relatively high point. It takes time for the market to correct industrial costs and the relationship between supply and demand in the market. Therefore, if copper inventories continue to rise or consolidate between communities, it may cause further declines in oil prices.

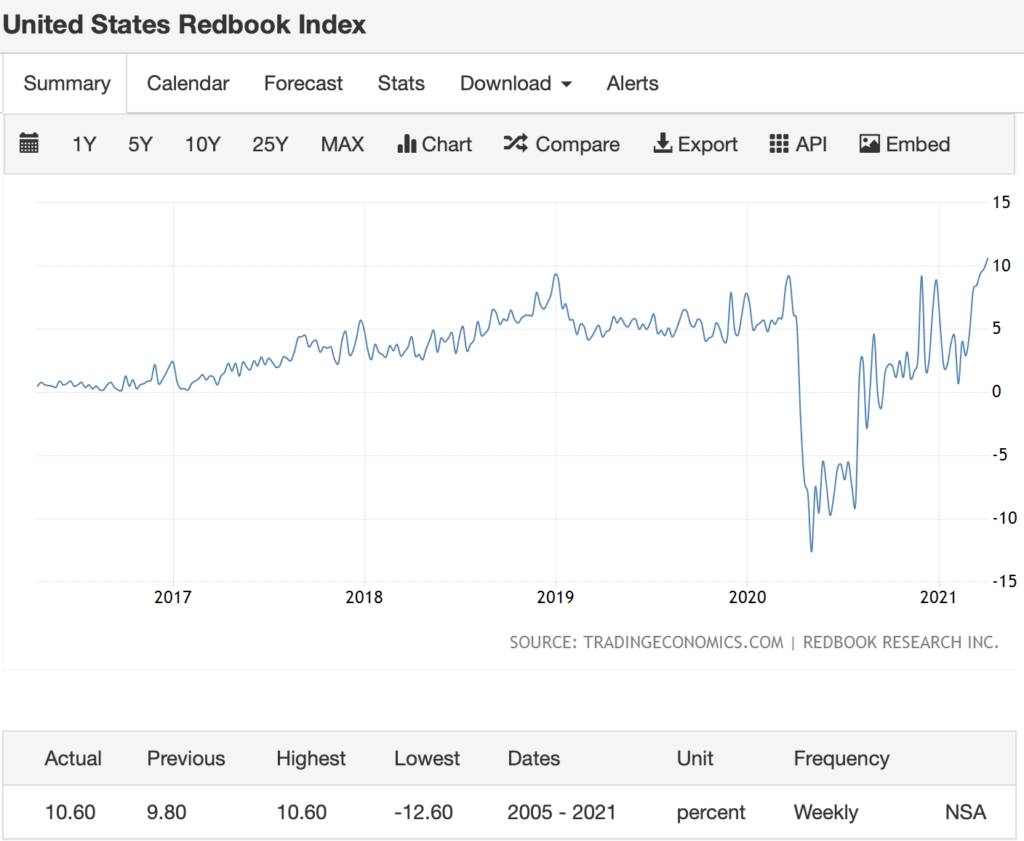

- Redbook:

The Redbook index has been in a positive range for the past period of time, once again verifying the correctness of the unemployment rate decline and the WEI index rising, and it also reflects that the overall market and community economic activities are improving. There is no special attention to this indicator for the time being, just keep observing it.

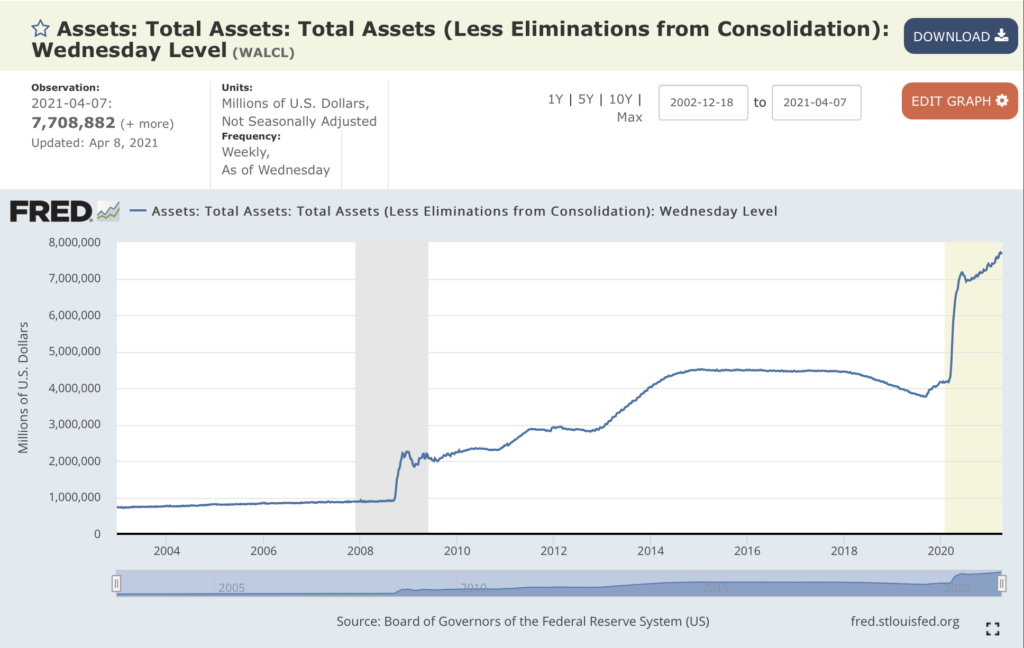

- The Fed’s position in the open market (Fed System Open Market Holdings):

Through the Fed’s open market position chart, we can see that the Fed is still buying. Many institutions and investors are closely watching whether the Fed will raise interest rates. Before the economy fully returns to normal, the Federal Reserve’s interest rate hikes may cause market panic, which may cause some funds to flow out of the securities market; but in the same way, under the unlimited QE policy, inflation expectations should be there, but The problem is that I don’t know how much adjustment will reduce market volatility or panic.

- Summary:

a. The continuous increase in copper stocks and crude oil stocks has a depressing effect on its prices. If copper prices and crude oil prices go down at the same time (note that not a sharp drop), it will affect the expectations of CPI and PPI (the same goes down), then This time will reduce the Fed and other governments’ inflation expectations and interest rate adjustments. Perhaps the low interest rate environment will continue for some time.

b. The vaccination rate is constantly increasing, and many schools have also notified students that they will start school normally in the fall. For the time being, the market is relatively optimistic about the recovery of the epidemic, but all this depends on the vaccine’s effectiveness against the virus. If the virus worsens or mutates again, it is not impossible to block the community again. We need to pay extra attention to the health status of the community.

c. The ratio of copper-to-gold and the ratio of oil-to-gold are in a fluctuating range, and the decline in these two ratios will ease the expectation of interest rate hikes.