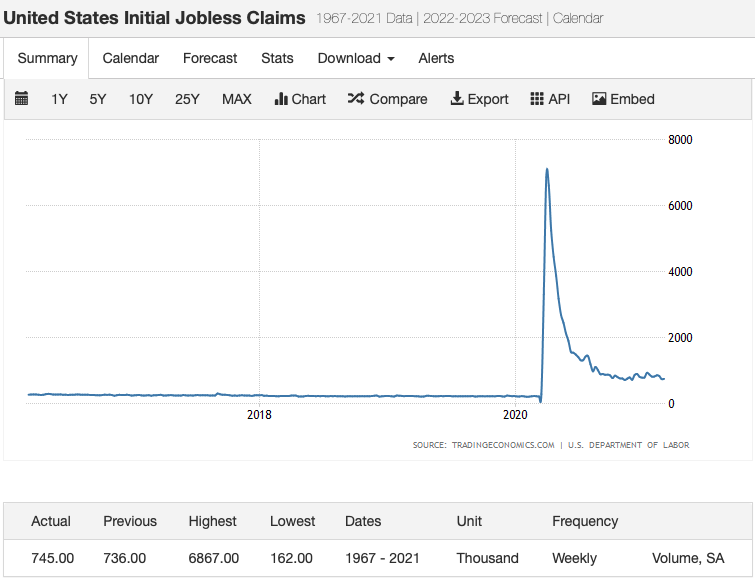

- Weekly unemployment rate:

From the charts below, we can find that the number of initial jobless claims has remained at the relative high lever compare to the history, but compare to the last year, the showed data has significantly dropped.

The number of continued jobless claims has continued to fall sharply, which is already lower than the high point of the 2008 financial crisis. The current data shows that thanks to the Covid-19 vaccine, many commercial activities have gradually opened up, and people are slowly returning to work. Judging from the absolute value of the unemployed rate, it is still not particularly optimistic, but this is the best result since the epidemic. Many people have already received the first vaccination, and appointments for vaccination are gradually being opened to ordinary citizens (children and adults). I believe that the economic situation of the entire society is gradually improving.

But I have a question here: Can a company whose business is unsustainable due to the epidemic continue to operate again, or can people who are permanently unemployed find new jobs, thereby further reducing the unemployment rate?

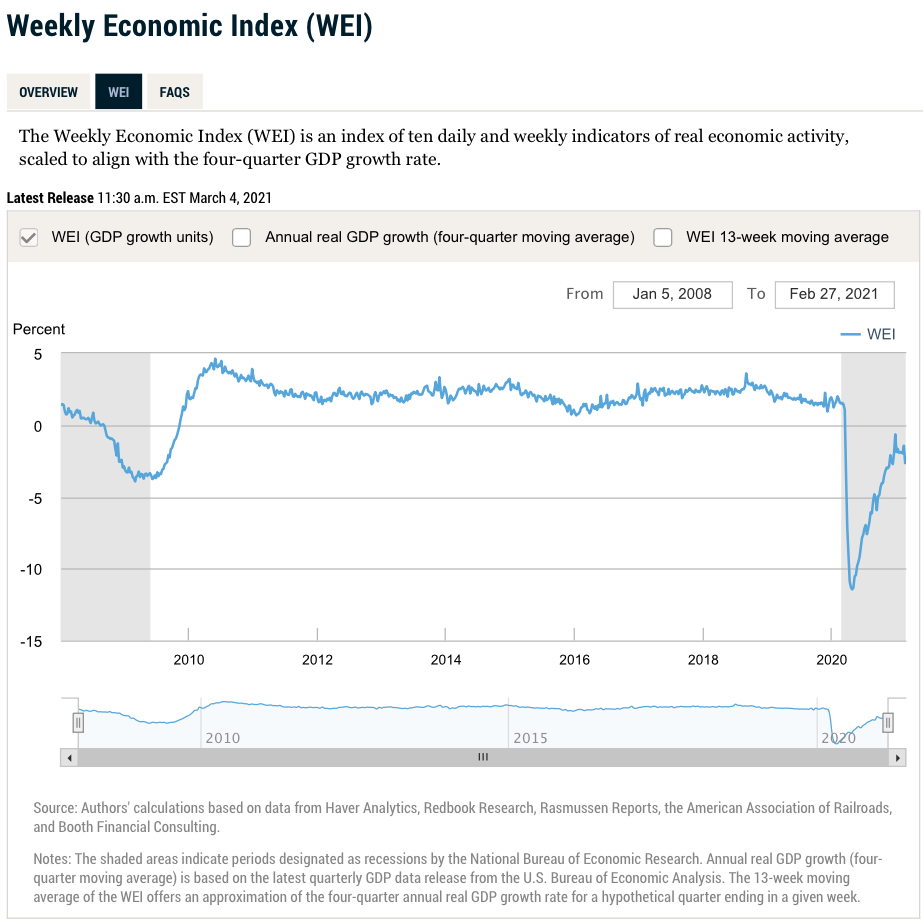

- The New York Fed’s Economic Activity Index (WEI):

The WEI index has fluctuated within a relatively high range for some time in the past, and there is currently no sign that this data will decline. Through the official website’s explanation: “The increase in the WEI for the week of February 27 is due to a decrease in initial unemployment insurance claims (relative to the same time last year) and rises in fuel sales and rail traffic, which more than offset declines in tax withholding and electricity output.”

The WEI index is very sensitive to overall economic activity, so we need to pay more attention to the operation of this index.

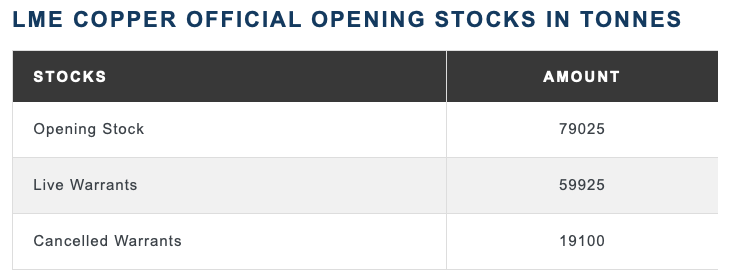

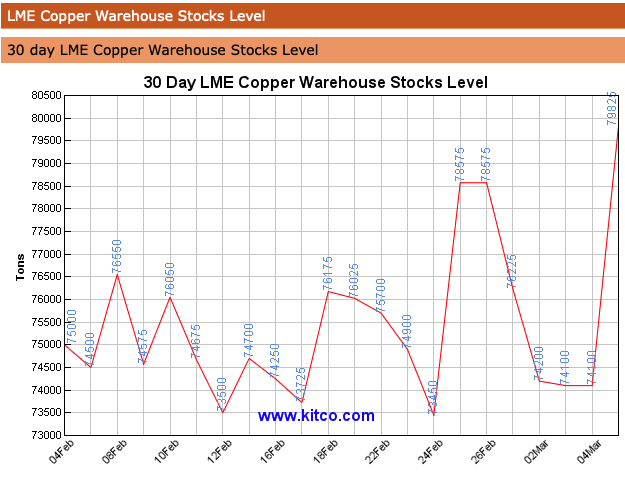

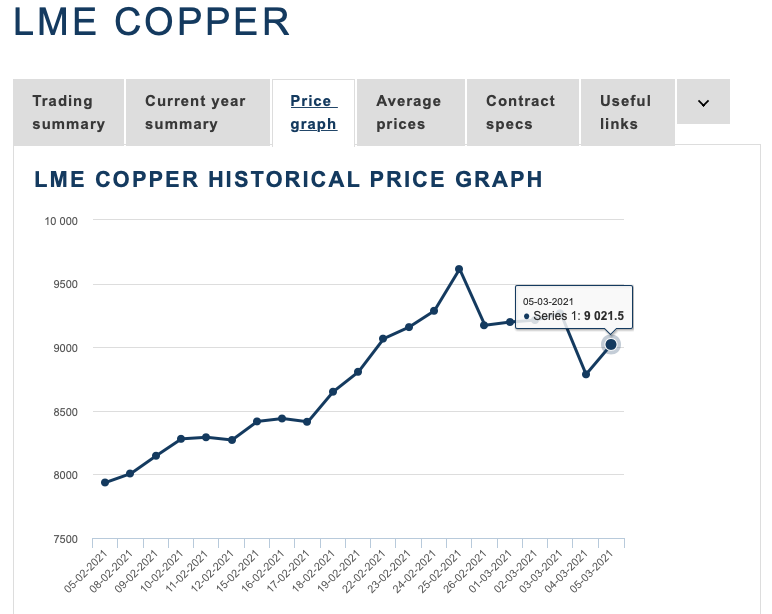

- Copper inventory of the three major exchanges (London Futures Exchange, Shanghai Futures Exchange, New York Mercantile Exchange):

From the figures below, we can see that in the past period of time, there has been a jump in copper inventories. The copper price has also fallen back slightly, but it is still in a relatively strong trend.

We may predict from basic economic activities that post-epidemic economic activities may be a blowout growth, and more processing plants may substantially add copper and other metal raw materials, which may lead to a further increase in copper prices. But in the short term, this situation may not appear.

Combined with the actual copper price trend, it is currently at a relatively high point, and this high point is a position that has been reached many times in history but has not successfully broken through, that is, we A bit of pressure often said. In the short term, I think there may be a slight decline in copper prices. Further analysis is in the last chapter.

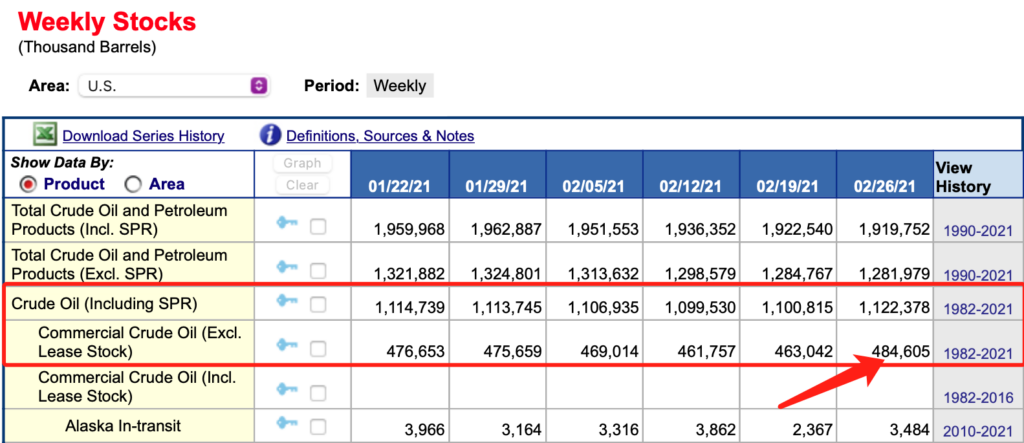

- Data on crude oil inventories and production in the United States:

Through the figure below, we can see that the recent crude oil inventories have also seen a sharp rise, while crude oil production has not seen a relatively large change. In addition, there has been a “backwardation” in crude oil futures. This is an issue that is worthy of our discussion and attention.

Here is a brief explanation of the meaning of Backwardation and Contango:

Backwardation is when the recent price is higher than the forward price. This phenomenon generally occurs because the demand for recent spot commodities is very urgent, and the price is willing to bear no matter how high it is. The greater the discount of the futures contract relative to the expected future spot price means that it compensates speculators for a longer period of time to bear the potential risk of falling commodity prices. Therefore, generally speaking, futures contracts with longer maturities are priced lower than those with shorter maturities, which is an act of reducing inventory.

Contango is when the forward price is higher than the recent price. Because the contract price of the recent month is actually close to the spot, this means that the spot price bought at the near end is low, and the far-end selling price can be locked through futures, and the selling price is high. Yes, there will be a risk-free profit. Therefore, the structure of Contango promotes the building of a library is a profitable behavior. The establishment of inventory is not based on seeing future price increases. In fact, the real driving force is risk-free arbitrage. The stronger the structure of this spread, the greater its arbitrage driving force, so that excess crude oil will be effectively converted into inventory, which is an act of increasing inventory.

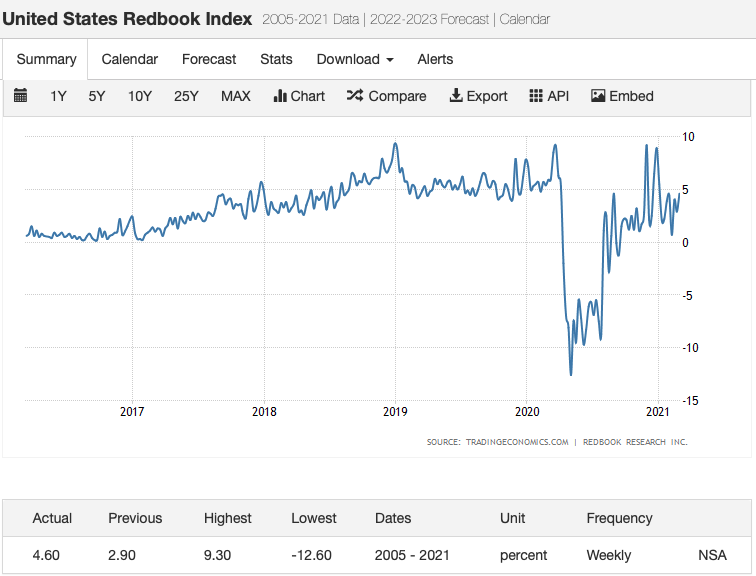

- Redbook (retail same-store sales index):

The Redbook indicator has been fluctuating up and down on a platform recently, and there have been no major changes. I think this situation may continue for a relatively long period of time, especially in large department stores, which is the industry most affected by the epidemic. We can focus on the field of online shopping.

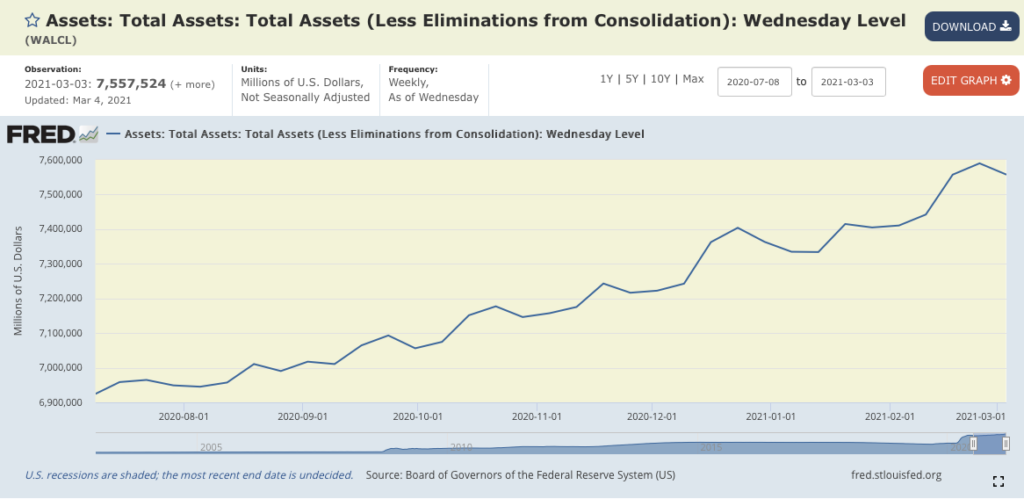

- The Fed’s position in the open market (Fed System Open Market Holdings):

The Fed’s public holdings declined slightly, but the holdings of US Treasury bonds continued to hit new highs, MBS holdings fell slightly, and TIPS holdings continued to hit new highs. In general, the Fed is still buying.

- Summary:

- Oil-to-gold ratio is the ratio of crude oil and gold prices, which reflects market inflation expectations, and affects the CPI index, which is the consumer price index; copper-to-gold ratio is the ratio of copper and gold prices, which is a risk-weighted economic activity index The concept affects the PPI index, which is the price index of industrial product production. The recent sharp rise in the price of copper and crude oil has directly led to a sharp rise in the copper-to-gold ratio and the oil-to-gold ratio, which will undoubtedly increase the U.S. Treasury bond yields. When the CPI and PPI rise at the same time, this will lead to a market inflation. The situation arises.

- The US dollar has stabilized at a low level recently, and it is very likely that the decline will stop here. If there is a strong rise in the US dollar here, combined with the resonant rise of CPI, PPI and Treasury bond yields, then this phenomenon will be a relatively big blow to the US stock market. The reason is that people’s investment costs rise (treasury bond yields and interest rates), and people’s investment risk appetite will decline (from high-risk investment to low-risk investment).

- I decided to do an industry research on the US retail industry, online shopping and department stores, and I will publish it in the industry research after completion.

Hi there colleagues, its great article concerning

cultureand fully defined, keep it up all the time.