- Weekly unemployment rate:

In the past week, U.S. stocks have fallen sharply, but the economic situation in the United States is still good. The initial application for unemployment benefits was 751,000, which was close to the previous high. The continuous application for unemployment benefits was 775,000 people: the employment situation is very good.

- The New York Fed’s Economic Activity Index (WEI):

The WEI indicator breaks through the 2008 low point, which indicates that economic indicators are rising rapidly, and economic recovery is expected to be in a positive state

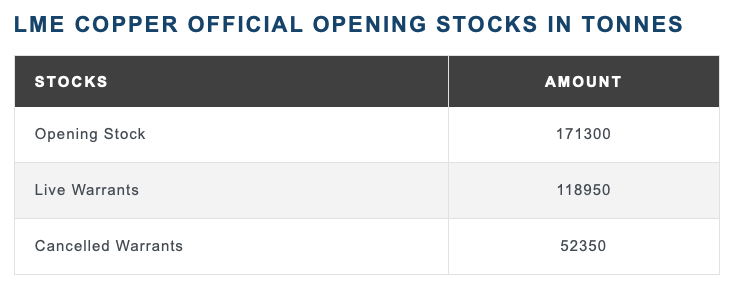

- Copper inventory of the three major exchanges (London Futures Exchange, Shanghai Futures Exchange, New York Mercantile Exchange):

Copper inventories have declined slightly in the past two weeks, but the price of copper is still hovering at a high level, and it has not caught up with the sharp drop in copper prices due to the increase in inventories. Here I think copper prices will continue to be strong. Assuming that the US economic stimulus bill cannot be passed, this may lead to a cliff-like decline in the consumption of American citizens (declining demand), which will greatly affect the consumption of small and medium-sized enterprises and residents, and this will affect commodities. Have a negative impact.

- US crude oil inventories and production data:

There is not much change in crude oil at present. According to Bloomberg data, we can know that there has been a large amount of crude oil holdings and trading volume recently. At the same time, due to the sharp drop in crude oil prices in the short term, I think there may be a technical speculative opportunity in the short term. The following Case1 means that if the decline continues in the short term in the future, I will consider making short-term long transactions for the purpose of making a technical rebound. Case2 means that if it stops falling in the short term and rebounds back to the 60MA moving average, I will go short around here.

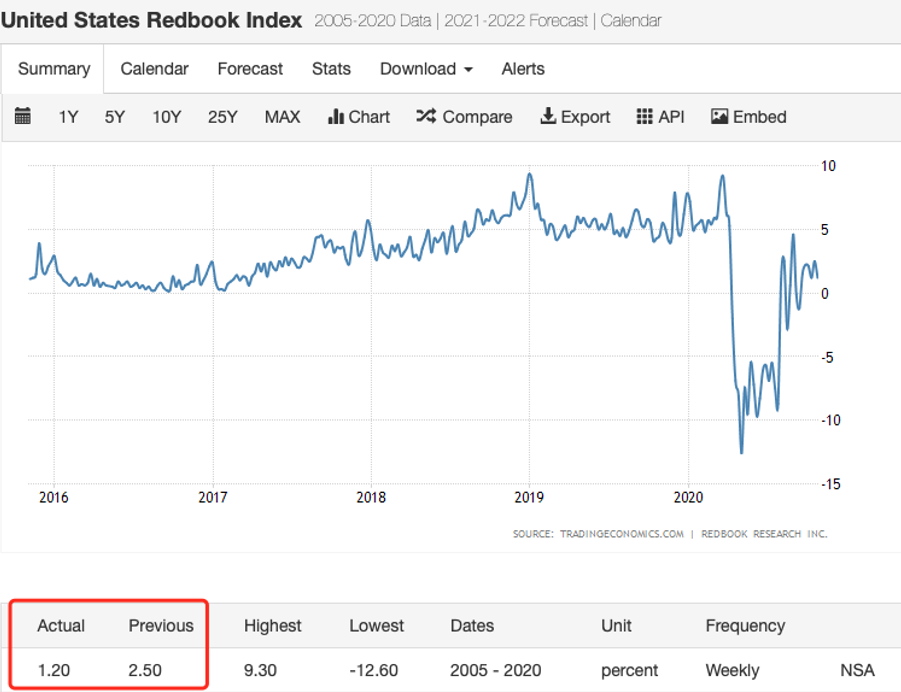

- Redbook (retail same store sales index):

This data has dropped slightly this week, but it is still in the positive range, so don’t worry too much.

Large shopping malls are still in the negative zone, and their status is hovering. Through the impact of this epidemic, people’s consumption behavior may be changed. (From offline to online)

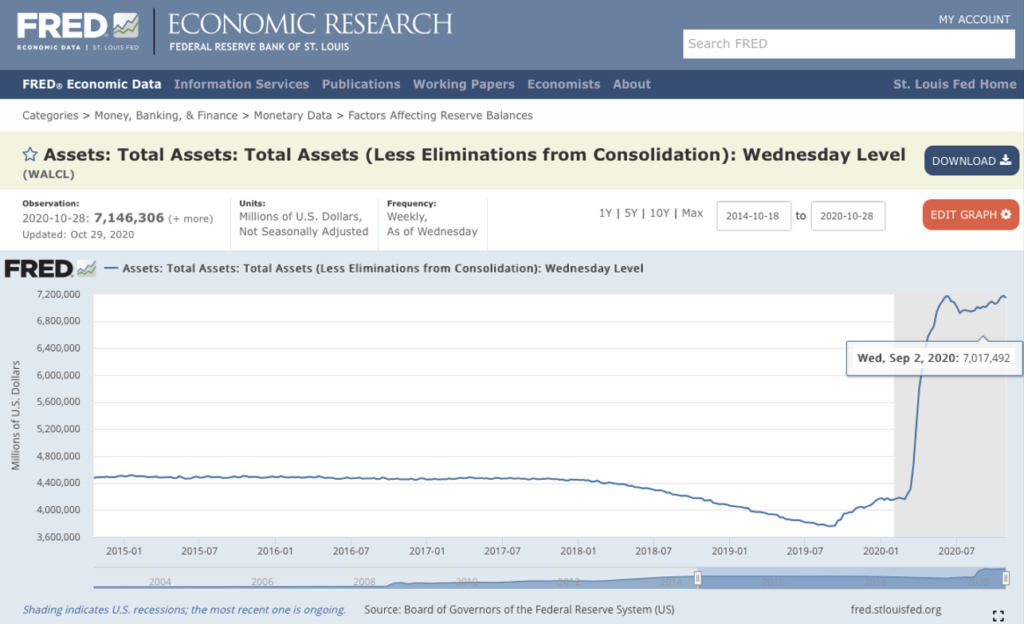

- The Fed’s position in the open market (Fed System Open Market Holdings):

The Fed’s position is still hovering at a high level, and it is still buying bonds. We propose a concept: the market capital price is determined by the buyer. As the Fed’s largest buyer in the world, we have reason to believe that his buying action is still an act to boost market confidence.

Conclusion

- Combined with the data display of initial jobless, continuous jobless, WEI indicators, and copper stocks and prices, it is not difficult to see that social-economic activities are recovering rapidly, the number of unemployment is falling rapidly, and many jobs are gradually returning to normal operations. It is undoubtedly a very good state for the market economy. At present, the overall economic system of the United States is tied to the economic stimulus bill. At the same time, the US government is also tied to the economic stimulus bill.

- Need to focus on the US dollar index and the 10-year US Treasury bond yield. If these two data resonate and go up, it will be extremely destructive to the stock market. Here is the point.

- The following is a short-term market deduction for SPY: